MIMIT 2025 Incentives for Innovative Startups: An Overview

In 2025, the support system for innovative startups promoted by the Ministry of Enterprises and Made in Italy (MIMIT) features significant changes and updates. This article provides an up-to-date overview of the available incentives, the most relevant requirements, and the main risks to consider.

2025 Grants for Women Entrepreneurs: All the Latest Opportunities

In 2025, Italian institutions have strengthened support measures for women’s entrepreneurship through grants, incentives, and financing to create, develop, and consolidate women-led businesses. In this article, we will analyze the most relevant opportunities to date, including national and regional measures, available resources, and emerging trends.

Calls and Incentives for Businesses 2025: A Practical Guide to Reduced IRES and the Transition Plan 5.0

The 2025 Budget Law introduced a significant reduction of the IRES rate (from 24% to 15%) for businesses that allocate profits to investments in capital goods or job creation.

Tax Incentives for Businesses: How the 2025 Budget Law Supports Growth and Innovation

The 2025 Budget Law introduced significant changes for Italian businesses, with the aim of stimulating investment and strengthening competitiveness. One of the most relevant measures concerns the reduction of the corporate income tax rate (IRES) from 24% to 20% for companies that meet specific requirements.

Fashion, Textile: Grants and Non-Repayable Funding for SMEs by June 3, 2025

Italian micro, small, and medium-sized enterprises (SMEs) operating in the fashion, textile, and tanning industries can now access a significant facilitated finance measure. Applications can be submitted by 12:00 PM on June.

Transition 5.0: The Incentive Plan for Businesses

Transition 5.0 is the new incentive plan launched by the Italian government to support businesses investing in digitalization, sustainability, and innovation. This measure represents an evolution of the previous Transition 4.0 Plan, with a particular focus on reducing environmental impact and improving energy efficiency.

Find our news

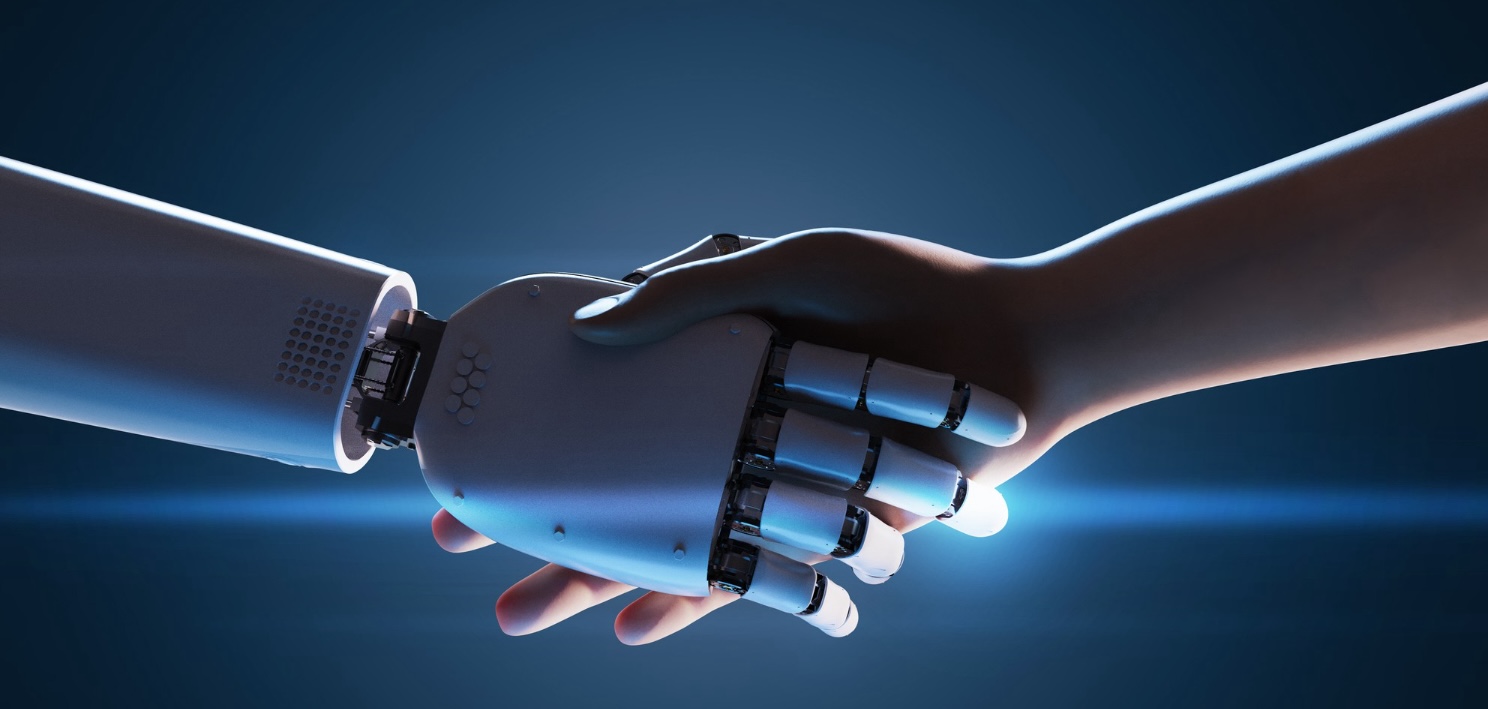

Get the most out of your assets.

Discover how to transform your

movable assets into financial resources.